The Theory of Interest (Illustrated)

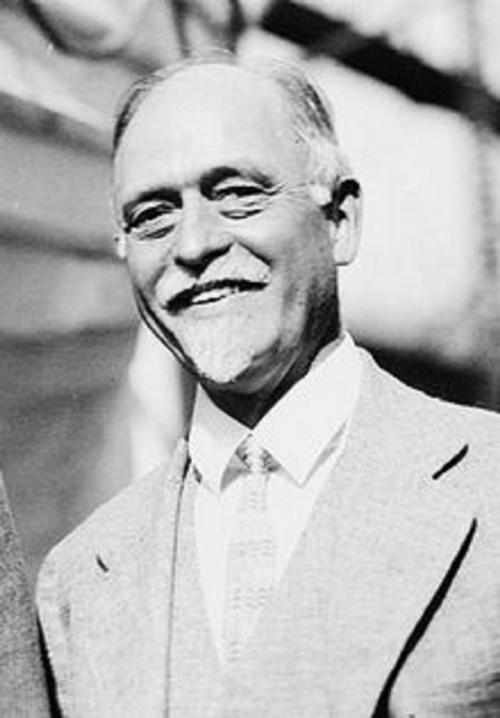

Business & Finance, Economics, Macroeconomics, Theory of Economics| Author: | Irving Fisher | ISBN: | 1230000268360 |

| Publisher: | AS Team | Publication: | September 16, 2014 |

| Imprint: | Language: | English |

| Author: | Irving Fisher |

| ISBN: | 1230000268360 |

| Publisher: | AS Team |

| Publication: | September 16, 2014 |

| Imprint: | |

| Language: | English |

This book has an active table of contents for readers to easy access to each chapter.

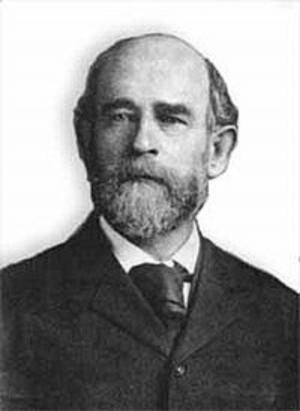

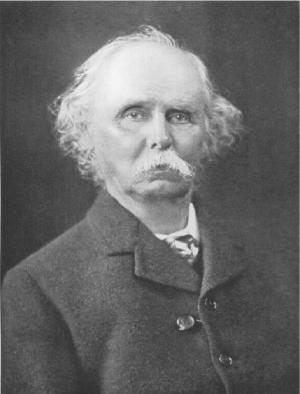

Irving Fisher was the greatest economist the United States has ever produced. He made important contributions to utility theory, general equilibrium, theory of capital, the quantity theory of money and interest rates. Fisher was also a pioneer of the development of index numbers for stock markets. Fisher equation, the Fisher hypothesis, the international Fisher effect, and the Fisher separation theorem were named after him.

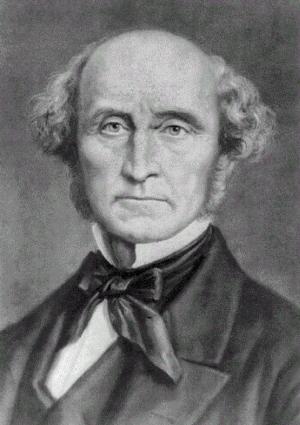

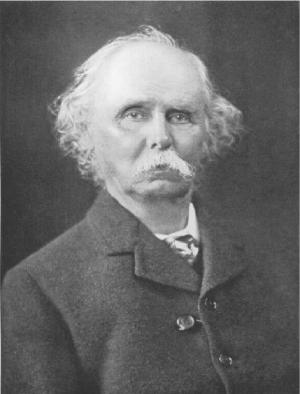

Following David Ricardo and John Keynes, Fisher was also one of those rare people who were deeply involved in investing and researching stock markets.

Fisher’s theory of debt deflation was widely used to explain the cause of the Great Depression and became more popular after the 2008 recession.

One of Fisher’s key contributions is Interest Theory. Fisher presented the theory of interest by giving a full demonstration of the principles that determine an interest rate in the book THE THEORY OF INTEREST. Irving Fisher used the book to answer the fundamental changes in the nature of the world economy including financing, the sensational inflation of the currencies of the combatants, and the remarkable developments in new scientific, industrial and agricultural revolution. Fisher pioneered a new theory that integrated all the aspects of the fundamental changes. He called it the theory of interest and defined the interest as "an index of a community's preference for a dollar of present income over a dollar of future income." He labeled his theory of interest the "impatience and opportunity" theory that is result from the interaction of two forces: the "time preference" people have for capital now, and the investment opportunity principle (that income invested now will yield greater income in the future).

This is a must-read book for readers who are also interested in the deepest thoughts and views about the theory of interest by Irving Fisher, one of the greatest economic thinkers on the planet.

This book has an active table of contents for readers to easy access to each chapter.

Irving Fisher was the greatest economist the United States has ever produced. He made important contributions to utility theory, general equilibrium, theory of capital, the quantity theory of money and interest rates. Fisher was also a pioneer of the development of index numbers for stock markets. Fisher equation, the Fisher hypothesis, the international Fisher effect, and the Fisher separation theorem were named after him.

Following David Ricardo and John Keynes, Fisher was also one of those rare people who were deeply involved in investing and researching stock markets.

Fisher’s theory of debt deflation was widely used to explain the cause of the Great Depression and became more popular after the 2008 recession.

One of Fisher’s key contributions is Interest Theory. Fisher presented the theory of interest by giving a full demonstration of the principles that determine an interest rate in the book THE THEORY OF INTEREST. Irving Fisher used the book to answer the fundamental changes in the nature of the world economy including financing, the sensational inflation of the currencies of the combatants, and the remarkable developments in new scientific, industrial and agricultural revolution. Fisher pioneered a new theory that integrated all the aspects of the fundamental changes. He called it the theory of interest and defined the interest as "an index of a community's preference for a dollar of present income over a dollar of future income." He labeled his theory of interest the "impatience and opportunity" theory that is result from the interaction of two forces: the "time preference" people have for capital now, and the investment opportunity principle (that income invested now will yield greater income in the future).

This is a must-read book for readers who are also interested in the deepest thoughts and views about the theory of interest by Irving Fisher, one of the greatest economic thinkers on the planet.